Home Remodeling Repair & Improve Ideas & Solutions Radio & Podcasts Contact Us Community

Presented by:

You're ready to ring in the New Year with noisemakers, confetti and those all-important resolutions for yourself…and your money pit. But even if you have the best intentions, your home improvement resolutions aren't likely to stick unless you have a workable plan for bringing them into action. That's where we come in with the tips and how-to's you’ll find in this week's issue. You can do-it-yourself, but you don't have to do it alone.

The Welcome Mat

This Issue

New Year's Resolutions For Your Home

With a few simple changes around the house, homeowners can expand their space, save money and make their home a healthier, better living environment. Here are a few tips for meeting your New Year's resolutions and getting your home in shape. read moreReturning Holiday Gifts: Hassle Free

Gifts are always given with good intention but returning gifts that while appreciated are not needed can be a hassle. Here are some great guidelines to help you navigate retailers for continued deals and many happy returns. read moreNew Year's Eve Gadgets for Parties of Every Pace

Planning a New Year's Eve celebration? Consider injecting your party with a little something special. Whether you're planning a quiet gathering of your closest friends or an all-out wild bash, there's an idea here to add panache to every at-home New Year's Eve soiree. read moreTop 5 Home Improvement Mistakes

The new year often brings a burst of energy for taking on projects around the house, but if you don't look before you leap, you might end up blundering right into a mistake. Get started off on the right foot with our list of 5 common home improvement snafus and how to avoid them. read moreAsk Tom & Leslie: Heating a Tile Floor

"I have a tile floor in my kitchen. It does not have any in-floor heating. Are there any good products that could be put on the underside of the subfloor in the basement to help heat the floor and room some?" read moreShare This Information With A Friend!

Simply forward this Email. And invite friends to register to receive this E-newsletter each week. If you would like to unsubscribe from our weekly newsletter, please refer to the unsubscribe directions at the bottom of this newsletter.

You are currently subscribed to moneypit_e-newsletter as: dabeisner@yahoo.com

To unsubscribe: click here or write to Squeaky Door Productions, Inc., 57 S. Main Street #133, Neptune, New Jersey 07753

Saturday, December 31, 2011

Home Improvement Resolutions - 12/30 Money Pit e-Newsletter

Thursday, December 29, 2011

Delaying Foreclosure: Borrowers Keep Homes Without Paying

Delaying Foreclosure: Borrowers Keep Homes Without Paying

Delinquent borrowers facing foreclosure are learning that they can stay in their homes for years, as long as they're willing to put up a fight.

Among the tactics: Challenging the bank's actions, waiting to file paperwork right up until the deadline, requesting the lender dig up original paperwork or, in some extreme cases, declaring bankruptcy.

Nationwide, the average time it takes to process a foreclosure -- from the first missed payment to the final foreclosure auction -- has climbed to 674 days from 253 days just four years ago, according to LPS Applied Analytics.

It takes much longer than that in Florida, where the process averages 1,027 days, nearly 3 years. In D.C., foreclosure averages 1,053 days and delinquent borrowers in New York often stay in their homes for an average of 906 days.

And while some borrowers are looking for ways to make good with lenders and get their homes back, many aren't paying a dime. Nearly 40% of homeowners in default have not made a payment in at least two years, according to LPS.

Many of these homeowners are staying in their homes based on a technicality. There is rarely any dispute over whether or not they have stopped paying their mortgage, said David Dunn, a partner at law firm Hogan Lovells in New York, who represents banks and other financial institutions in foreclosure cases.

"In my experience, they never say, 'I'm not delinquent' or 'I want to pay my bill but I'm confused over who to send it to,' or 'Oh my God, you mean I didn't pay my mortgage?' They're not in technical default. They're in default because they're not paying," he said.

Ironically enough, the banks have given delinquent borrowers some of the ammunition they need to delay the foreclosure process. During the "robo-signing" scandal in 2010, it was revealed that bank employees signed paperwork attesting to facts they had no personal knowledge of. Now, borrowers are routinely challenging that paperwork.

A Staten Island, N.Y. man who owed $300,000 on his mortgage and hadn't made a payment in two years, said his attorney used the robo-signing issue to fight his foreclosure.

In his case, the lender's paperwork included many different papers signed by the same employee. The problem was that the signatures didn't match. The judge dismissed the lender's case against the borrower, although it can be re-filed.

"It looks like I'll be in my home for some time to come," said the homeowner, who asked to remain anonymous. He said he is currently not making any payments on his home.

Sometimes just asking the bank to produce the paperwork that shows it is the legal holder of the mortgage note can stall a repossession, said attorney Robert Brown. Since mortgages are often transferred electronically, the official paperwork often gets misplaced.

"My lawyer asked my bank to produce an affidavit that entitled them to foreclose," said a client of Brown's, who lives in Harlem and also asked to remain anonymous. "They couldn't do it."

The case was dismissed, without prejudice, though the lender can try again -- if it finds the paperwork.

In some of the more extreme cases, borrowers will file for bankruptcy in order to block a foreclosure. In these instances, courts order creditors to cease their collection activities immediately. Home auctions can be postponed as the bankruptcy plays out, which can take months.

The ensuing delays are further harming the housing market. People who stay in homes undergoing foreclosure for years often don't maintain the properties, causing blight and lowering property values in the surrounding neighborhoods, said Dunn.

Then there are the court costs that lenders bear, which will eventually be borne by home buyers as lenders increase their borrowing fees to cover the increased risk, Dunn said.

David Berenbaum of the National Community Reinvestment Coalition (NCRC), a community activism group, disputes the contention that owners are gaming the system for free rent and hurting the housing market.

"Most people do everything in their power to maintain these homes," he said. "They take in relatives, get second jobs and even rent out rooms."

What really needs to be done, he said, is for lenders to work harder to find solutions that allow delinquent borrowers who can afford to make reasonable mortgage payments to keep their homes.

Distressed Commercial Properties Level Off

Distressed Commercial Properties Level Off

Daily Real Estate News | Thursday, December 29, 2011

-->

Are better days ahead for commercial real estate? A new report by Real Capital Analytics shows the number of distressed commercial properties is plateauing and expected to continue to do so in the new year. Distressed properties — which include commercial properties that are in default, foreclosure, or repossessed by lenders — had totaled $171.6 billion in October 2011, a decrease from topping off at $191.5 billion in March 2010, according to Real Capital Analytics.

“The real test of the distress plateau is likely to be seen in 2012 and 2013, when about $300 billion in loans comes due each year,” according to a recent article in the Washington Post.

At $41.9 billion, the office sector continues to have the largest number of distressed commercial properties. But that number has been steadily declining — about 11.8 percent less than its peak reached in October 2010.

The apartment sector has the second-highest level of distressed commercial properties with $35.6 billion in troubled loans, according to the Washington Post article. Land and other property types have about $29.8 billion in distressed assets.

The metro areas with the largest number of commercial properties in distress is Manhattan, in which the total volume of distress properties stands at $11.8 billion, followed by L.A.-Orange County with $10 billion. Meanwhile, Houston has the lowest at $111 per capita.

Source: “Amount of Distressed Real Estate Could be on Way Down,” Washington Post (Dec. 26, 2011)

FHA Extends Anti-Flipping Waiver to Speed Sales

FHA Extends Anti-Flipping Waiver to Speed Sales

Daily Real Estate News | Thursday, December 29, 2011

-->

The Federal Housing Administration is extending its “anti-flipping” waiver through the end of 2012, which allows buyers to purchase homes that have already been sold in the last 90 days.

The waiver, which was soon set to expire, is “intended to accelerate the resale of foreclosed properties in neighborhoods struggling to overcome the possible effects of abandonment and blight,” Carol J. Galante, the acting Federal Housing Administration commissioner, said in a statement. “FHA remains a critical source of mortgage financing and stability and we must make every effort to promote recovery in every responsible way we can.”

An anti-flipping rule originally took effect in 2003 to stop a spike in home flipping that was being blamed on driving up home prices during the housing boom. The rule prevented FHA-backed loans from being used to purchase homes that had been owned by a seller for less than 90 days. But the U.S. Department of Housing and Urban Development decided to reconsider the 90-day limit in 2010 after skyrocketing foreclosures and abandoned homes were causing blight in neighborhoods across the country and hampering nearby property values.

The temporary waiver to the anti-flipping rule will allow buyers and investors to quickly resell refurbished homes and not have to wait 90 days to do so. Since the waiver took place in 2010, FHA has insured nearly 42,000 mortgages worth more than $7 billion on homes resold within 90 days of the last purchase, according to HUD.

"It's certainly an inducement to move real estate and reduce inventories," says Don Cameron, a real estate investor who owns a franchise of We Buy Ugly Houses in South Florida. "Why wait 90 days before you can close on a home?"

The waiver, however, still prevents predatory flipping, and sellers must justify any increases in value if the sales price of the property is 20 percent more than what the seller had recently purchased it for (such as by providing extra documentation on renovation expenses). Sales also must be in “arms-length, with no identity of interest between the buyer and seller or other parties participating in the sales transaction.”

Source: “Government Extends Waiver of Anti-Flipping Law, Allowing Homes to be Bought and then Sold in 90 Days,” McClatchy-Tribune Regional News (Dec. 29, 2011) and HUD.gov

America's Largest Luxury Home Sales of 2011

America's Largest Luxury Home Sales of 2011

By Venessa Wong, Bloomberg Businessweek

December 27, 2011

Overall, the U.S. housing market may have failed to dazzle in 2011, but this year did mark a new record in luxury real estate. In February, a 25,500-square-foot mansion in Los Altos Hills, Calif., sold for $100 million, the biggest known sale of a single-family home in the U.S. (many large transactions are not publicized). The seller, Fred Chan, who founded ESS Technology in Fremont, Calif., helped finance the deal by extending a $50 million loan to the buyer, Yuri Milner, the Russian-born founder of Digital Sky Technologies.

| More from Businessweek.com » America’s Richest Zip Codes 2011 » World's Most Expensive Cities 2011s » The Most Expensive Small Towns in America |

This was also the year Candy Spelling sold her 14-bedroom mansion—on the market since 2008 for $150 million—at a discounted price of $85 million to Petra Ecclestone, the 22-year-old daughter of Formula One billionaire Bernie Ecclestone. “Prices have come down [over the past few years], so it’s an opportune time to buy,” says Philip A. White, president and chief operating officer of Sotheby’s International Realty.

To build a list of the most expensive homes sold in 2011, Businessweek.com asked Realogy (the parent company of such brands as Sotheby’s International Realty, Coldwell Banker, Corcoran, Better Homes & Gardens Real Estate, Century 21, and ERA), Christie’s International Real Estate, and Brown Harris Stevens for their biggest sales this year. We also collected sales data from real estate websites Trulia.com, Zillow.com, and StreetEasy.com, as well as from such real estate agents as David Kean at the John Aaroe Group in Beverly Hills, Calif., and Terry Baxendale at Shore & Country Properties near Greenwich, Conn.

Here's America's 10 most expensive luxury home sales of 2011:

|

| No. 10 - The $36.5 million Harkness Mansion in New York City. Photo: William Halsey/Bloomberg Businessweek |

This five-story limestone mansion, previously acquired by billionaire investor J. Christopher Flowers for $53.6 million in 2006, sold in August to art dealer Larry Gagosian, reported the New York Observer. The massive Upper East Side townhouse is 50 feet wide and measures 21,700 sq. ft.

No. 9 - Field Point Park waterfront mansion

84 Field Point Circle, Greenwich, CT

Sale price: $39,500,000

84 Field Point Circle, Greenwich, CT

Sale price: $39,500,000

|

| No. 9 - The $39.5 million Field Point Park waterfront mansion in Greenwich, CT. Photo: Sotheby's International Realty |

This waterfront estate, on 4.26 acres, has a 20,777-sq.-ft. main house of stone, two guesthouses, terraces with a waterfall and koi ponds, outdoor and indoor pools, and a historic suspension bridge to the pier, according to listing details.

|

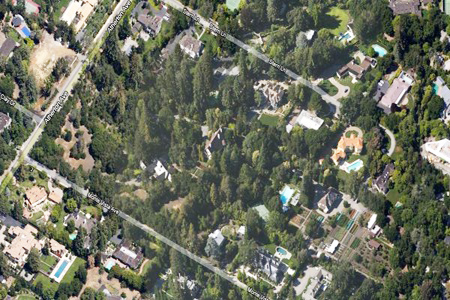

| No. 8 - The $40 million, La Belle Vie in Los Angeles. Photo: Google Maps |

Listed at $53 million since 2009, this Bel Air mansion reportedly sold in April to Gene Sykes, a managing director at Goldman Sachs. The house was built for philanthropist Iris Cantor by her husband, Bernard Gerald Cantor, in 1993, according to the Los Angeles Times. Iris Cantor had tried to quietly sell the property for $60 million, Forbes.com reported in 2000. Listing information on Zillow.com shows that the property has eight bedrooms, 21 baths, three kitchens, 12 fireplaces, a staff wing, pool, tennis court, billiard room, gym, and beauty salon.

|

| No. 7 - The $42.9 million Porcupine Creek in Rancho Mirage, CA. Photo: Christie’s International Real Estate |

Covering 249 acres, the Porcupine Creek golf course estate has a 18,430-sq.-ft. main residence, four 1,860-sq.-ft. guesthouses, and four 600-sq.-ft. casitas, reported palmspringslife.com. The property was built by real estate developer Tim Blixseth and Edra Blixseth (who divorced in 2008) and was listed at $75 million after Edra Blixseth filed for bankruptcy. Oracle’s (ORCL) co-founder and chief executive, Larry Ellison, reportedly bought the estate in late January 2011.

|

| No. 5 - The $48 million Vanderbilt Mansion in New York City. Photo: William Halsey/Bloomberg Businessweek |

This townhouse, in the Lenox Hill section of Manhattan, was built in 1881 and was once owned by Alice Gwynne Vanderbilt. It sold in July to Johnson & Johnson heiress Libet Johnson, reported the New York Post. The sellers, Roger Barnett, founder of beauty.com, and author Sloan Lindermann Barnett, bought the home in 2001 for $11 million. The mansion is tied with a $48 million condo in the Plaza for fifth place.

No. 5 (tie) - The Plaza, condo unit

768 Fifth Avenue, #1207 and #1209, New York, N.Y.

Sale price: $48,000,000

768 Fifth Avenue, #1207 and #1209, New York, N.Y.

Sale price: $48,000,000

|

| No. 5 - The $48 million Plaza Condo unit in New York City. Photo: Emile-Wamsteker/Bloomberg |

The Russian composer Igor Krutoy and his wife, Olga, bought this 6,000-sq.-ft. condo in March. Howard Lorber, chairman of Prudential Douglas Elliman Real Estate, said this was a record price for a single condo sold in New York City, according to Bloomberg News. The apartment is tied with the $48 million Vanderbilt mansion for fifth place.

|

| No. 4 - Pine Brook, a $53 million home in Atherton, CA. Photo: Google Maps |

This 12-acre estate, originally listed at $59.5 million, sold in September for $53 million. The property has an 11,000-sq.-ft. English Tudor-style house as well as a 6,500-sq.-ft. guesthouse, according to listing details. It was sold by the children of San Francisco philanthropist and arts patron Madeleine Haas Russell, who died in 1999, to an anonymous buyer, the Wall Street Journal reported.

|

| No. 3 - Spelling Manor, at $85 million, in Los Angeles. Photo: Christie’s International Real Estate |

The Spelling Manor, for sale since 2008, sold in July 2011 at 56.7 percent of the original listing price of $150 million. The Wall Street Journal reported that the buyer was Petra Ecclestone, the 22-year-old daughter of British billionaire Bernie Ecclestone, who is chief executive of the Formula One Administration. The three-story, 56,500-sq.-ft. home sits on 4.7 acres.

No. 2 - 15 Central Park West, penthouse

15 Central Park West, Penthouse, New York, N.Y.

Sale price: $88 million

15 Central Park West, Penthouse, New York, N.Y.

Sale price: $88 million

|

| No. 2 - The $88 million apartment at 15 Central Park West, New York City. Photo: JB Reed/Bloomberg |

Former Citigroup chairman Sandy Weill just listed this 10-room condo at the Robert A.M. Stern-designed 15 Central Park West in November for $88 million, promising to give the proceeds to charity. Forbes.com reported on Dec. 19 that Ekaterina Rybolovleva, the 22-year-old daughter of Russian billionaire Dmitriy Rybolovlev, bought the unit at the full price. This would be a new record price for homes sold in New York City. Other notable residents have included Goldman Sachs CEO Lloyd Blankfein, hedgefunder Daniel Lobe and rock star Sting.

|

| No. 1 - The $100 million Los Altos Hills mansion. Photo: Paul Sakuma/AP Photo |

At $100 million, the top transaction this year set a new high for known sales of single-family homes. This 25,500-sq.-ft. mansion in the Los Altos Hills has five bedrooms and nine bathrooms, according to listing data. Russian tech billionaire Yuri Milner, founder of Digital Sky Technologies, bought the property in February from Fred Chan, founder of ESS Technology in Fremont, Calif., and his wife Annie, reported the Wall Street Journal. The sellers lent Milner $50 million to help finance the sale.

Pending Home Sales Rise Again

Pending Home Sales Rise Again

Daily Real Estate News | Thursday, December 29, 2011

-->

Pending home sales continued to gain in November and reached the highest level in 19 months, according to the National Association of REALTORS®.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 7.3 percent to 100.1 in November from an upwardly revised 93.3 in October and is 5.9 percent above November 2010 when it stood at 94.5. The October upward revision resulted in a 10.4 percent monthly gain.

The last time the index was higher was in April 2010 when it reached 111.5 as buyers rushed to beat the deadline for the home buyer tax credit. The data reflects contracts but not closings.

Lawrence Yun, NAR chief economist, said the gains may result partially from delayed transactions. “Housing affordability conditions are at a record high and there is a pent-up demand from buyers who’ve been on the sidelines, but contract failures have been running unusually high,” he said. “Some of the increase in pending home sales appears to be from buyers recommitting after an initial contract ran into problems, often with the mortgage.

“November is doing reasonably well in comparison with the past year. The sustained rise in contract activity suggests that closed existing-home sales, which are the important final economic impact figures, should continue to improve in the months ahead,” Yun added.

Pending home sales are not affected by the recently published rebenchmarking of existing-home sales because the index uses a different methodology based directly on contract signings, and is adjusted for seasonality.

The PHSI in the Northeast rose 8.1 percent to 77.1 in November but is 0.3 percent below November 2010. In the Midwest the index increased 3.3 percent to 91.6 in November and is 9.5 percent above a year ago. Pending home sales in the South rose 4.3 percent in November to an index of 103.8 and remain 8.7 percent above November 2010. In the West the index surged 14.9 percent to 121.2 in November and is 2.9 percent higher than a year ago.

Source: NAR

Wednesday, December 21, 2011

Existing-Home Sales Rise in November

Existing-home sales rose again last month, according to data released Wednesday by the National Association of Realtors (NAR). That assessment, however, is coming off of lower sales numbers than previously thought, reflecting revisions to NAR’s data going back to 2007. The trade group has adjusted sales and inventory figures for the last four years downward by 14.3 percent. NAR’s latest monthly report shows sales of previously owned homes increased 4.0 percent to an annual rate of 4.42 million in November from 4.25 million in October, and are 12.2 percent above the 3.94 million-unit pace in November 2010.

Tuesday, December 20, 2011

Mortgage Fees Would Rise Under Payroll Tax Cut Deal

Best of Success,

Duane Beisner

Read more: http://www.foxnews.com/politics/2011/12/17/mortgage-fees-would-rise-under-payroll-tax-cut-deal/?utm_source=twitterfeed&utm_medium=twitter&utm_campaign=Feed%3A+foxnews%2Fpolitics+%28Internal+-+Politics+-+Text%29#ixzz1h6AEeUvI

Duane Beisner

Mortgage Fees Would Rise Under Payroll Tax Cut Deal

Published December 17, 2011

| FoxNews.com

-

APJuly 13, 2008: Shown here is the Freddie Mac headquarters in McLean, Va

APJuly 13, 2008: Shown here is the Freddie Mac headquarters in McLean, Va

Homebuyers, beware.

In exchange for a two-month tax cut, the Senate on Saturday approved a permanent increase in fees attached to mortgages backed by Fannie Mae, Freddie Mac and the Federal Housing Administration (FHA).

The fee hike would apply to new mortgages and new refinances, and would last for the life of the loans.

The increase is meant to pay for the roughly $33 billion package the Senate approved Saturday to extend a 2 percentage point payroll tax cut for another two months. The Obama administration says 160 million people benefit from that tax cut.

But the mortgage fee provision would have widespread long-term impact, considering nine out of 10 mortgages go through one of the three government-sponsored finance organizations affected.

The new fee increase would amount to about $15 a month more for a $200,000 mortgage, according to a senior Democratic official.

That's $180 a year, or $360 a year for a $400,000 mortgage. Homeowners would have the fee hike built into their loan -- the mortgage provider would then send that extra revenue to the Treasury.

The idea behind the fee is to encourage more homeowners to get into the private market, as opposed to seeking loans backed by troubled entities like Fannie and Freddie.

"Taxpayers are losing every quarter on Fannie and Freddie," a senior Senate Democratic aide said. "We want to lessen the burden on the taxpayers (who are on the hook for failed government-backed loans)."

The aide added, "This is an incentive to go to the private-sector mortgage market."

A fact sheet on the Senate bill sent out Saturday to House Republicans noted that the offset has "bipartisan support" and was included in the House GOP-backed payroll tax cut bill. It also was included in President Obama's list of suggestions to the now-defunct "Super Committee" tasked with reducing the deficit.

The House still must vote on the bill. The two-month tax cut is estimated to be worth about $165 for someone making $50,000 a year.

While lawmakers will say that the mortgage fee hike means the payroll tax cut is fully paid for, the timetables for the tax cut itself and the revenue from the fee are very different.

The Congressional Budget Office estimates that while the tax cut lasts two months, it will take 10 years for the associated fee hike to drum up an estimated $35.7 billion and replenish the lost revenue. That rhetorical tactic is common on Capitol Hill -- lawmakers frequently say bills are "paid for" when in fact it takes a decade for that to be the case.

Fox News' Trish Turner contributed to this report.

Selling a Haunted House

Selling a Haunted House

Published on Tuesday, November 15, 2011, 8:28 PM Last Update: 2 hour(s) ago by Loren Keim

Category: All Articles » Motivation and Inspiration

The term “historic” is relative depending on your point of reference. Several years ago, a client, relocating from London, asked us to find her a newer home, and since she made a point of the fact that she didn’t want something “old”, we set up showings on homes that were built within the past three years only to find upon her arrival that, her point of reference being London, she was actually willing to consider anything built within the last fifty years.

The term “historic” is relative depending on your point of reference. Several years ago, a client, relocating from London, asked us to find her a newer home, and since she made a point of the fact that she didn’t want something “old”, we set up showings on homes that were built within the past three years only to find upon her arrival that, her point of reference being London, she was actually willing to consider anything built within the last fifty years. Over the past few years, I’ve spent quite a bit of time in Saint Charles, Missouri. I absolutely love the Saint Louis metro area, but I find it funny how often the residents ramble on about how incredible it is to live in an area that is really old and historic, by which they mean anything that dates back to the days of Lewis and Clarke. These are people who would probably be shocked to learn that there are homes in Bethlehem, Pennsylvania, where I’ve spent most of my career, that predate Saint Charles by about 200 years.

Allentown and Bethlehem are very old cities when compared with most of the country, with some homes dating back to the 1600’s, which helps to explain the number of ghost stories that are connected with various properties. In one instance, my team listed a historic bed and breakfast for sale, a gorgeous three-story Victorian style house which featured a beautiful turret and a wrap-around porch decorated with very intricate latticed woodwork. The home was located in a coal mining area, where most of the coal mines had closed.

But as far as the owners were concerned, the attractiveness of the property, which had been built at the turn of the century, was not the most important marketing ploy since they were convinced that the house was haunted, not simply by one apparition, but by three. They told me that their guests traveled from all corners of the country in hopes of catching a glimpse of these restless spirits, Pamela’s favorite being the one that now and then marched through one of the second floor bedrooms, looking as human as life, except that it walked about eighteen inches above the floor. And although I never personally saw a ghost, goblin or ghoul, I did manage to sell the house for them in relatively short order.

Because of my success with this unique property, I received a call from the owner of another like it, a two hundred year old house located in Allentown. The owner specified that I arrive between seven and ten after seven in order to see the ghost which, he claimed, made an appearance every evening at precisely 7:17 pm.

Sure enough, seventeen minutes past seven, on the dot, there was a slam of a door on the second floor. The dog perked up his ears and stared at the staircase that stretched down to the kitchen and the hair on the back of my neck stood up as I heard the steps creaked as if someone was coming down them.

The dog appeared to follow the wrath’s progress with his eyes as it moved through the kitchen and out onto the back porch. I actually heard the screen door slam, despite the fact that, to my certain knowledge, it never opened or closed. Once the apparition was gone, the dog once again rested his head on his master’s lap.

The owner claimed that since this event happened each and every night, this was his ticket to a high price for his home since a haunted house would attract buyers from far and wide.

Whether the home was truly haunted or this was an elaborate hoax, I thought the idea was terrible. Who in their right mind would buy a home simply because they believed it to be haunted? The bed and breakfast had sold because of its many unique characteristics. However, if a buyer is planning to purchase a home, whether or not he or she believes in ghosts, he or she is probably not taking the chance on meeting one in the middle of the night, when there are plenty of other homes out there to purchase.

However, Brian’s enthusiasm convinced me that perhaps some other avid ghost enthusiast would appear to purchase the home, and as a consequence, we advertised the property locally and in the tri-state area for months, but no one even came to view it. In fact, I received calls from competing agents who thought I was completely out of my gourd.

We contacted newspapers and expanded our marketing and our search for a buyer further and further. No one looked. The owner eventually grew tired and removed the home from the market.

Loren Keim is the Broker / President of Century 21 Keim Realtors, an Adjunct Professor of Real Estate at Lehigh University, in the Top 1% of Realtors, a National Speaker and Author of

Saturday, December 17, 2011

Inflation cools

Inflation coolsThe Labor Department said today that the Consumer Price Index was

unchanged last month. Economists had expected an increase of

0.1%. Prices rose 3.4% in the 12 months through November. That

is off from the 3-year high of 3.9% clocked in September, and

Friday's report backs the view that the spike in inflation is

subsiding. However, some of the data in the report could give

pause to policymakers still concerned about inflation. Outside

food and energy, prices climbed 0.2%. These so-called core

prices rose 2.2% in the 12 months through November, up from 2.1%

in October. Prices for food rose 0.1% during November. Within

the core index, prices for apparel jumped 0.6%. But dragging

down the overall index, gasoline fell 2.4% and prices for new

vehicles were down 0.3%. Economists and investors see inflation slowing over the coming

months, which could help convince the Federal Reserve to do more

to bring down the country's 8.6% unemployment rate. Most

economists have said the Fed's next meeting on Jan. 24-25 would

be the more likely occasion for any new moves to bring down

borrowing costs and help growth. The US central bank has held

overnight interest rates near zero since December 2008 and has

bought $2.3 trillion in government and mortgage-related bonds in

a further attempt to stimulate a robust recovery.

unchanged last month. Economists had expected an increase of

0.1%. Prices rose 3.4% in the 12 months through November. That

is off from the 3-year high of 3.9% clocked in September, and

Friday's report backs the view that the spike in inflation is

subsiding. However, some of the data in the report could give

pause to policymakers still concerned about inflation. Outside

food and energy, prices climbed 0.2%. These so-called core

prices rose 2.2% in the 12 months through November, up from 2.1%

in October. Prices for food rose 0.1% during November. Within

the core index, prices for apparel jumped 0.6%. But dragging

down the overall index, gasoline fell 2.4% and prices for new

vehicles were down 0.3%. Economists and investors see inflation slowing over the coming

months, which could help convince the Federal Reserve to do more

to bring down the country's 8.6% unemployment rate. Most

economists have said the Fed's next meeting on Jan. 24-25 would

be the more likely occasion for any new moves to bring down

borrowing costs and help growth. The US central bank has held

overnight interest rates near zero since December 2008 and has

bought $2.3 trillion in government and mortgage-related bonds in

a further attempt to stimulate a robust recovery.

Unpluggged 2011

Holiday greeting.pdf Download this file

It's easy to get swept into the holiday frenzy, spending money you really don't have, making commitments because you think you just can't say “no.” But you can put a stop to the madness and regain the joy of the season.James P. Sargen did just that after decades of holiday excess. As general manager of a big-city shopping center early in his career, he worked 80-hour weeks during the holiday season. Raising a young family, his wife enjoyed entertaining and decorating, he says, but he dreaded the holidays. There were extended-family dinners, two elaborately decorated trees, a large holiday event for more than 200 the week before Christmas and more than 300 holiday cards to mail.Each year, he found himself caught up in this whirlwind of obligations. Sargen says he felt trapped in stressful commitments and the spending frenzy.The turning point came when he realized the true value of the holidays is spending time with family and friends. “How you did it was less important than connecting with the people you love or care for,” he says. Author and psychologist Cheryl Dellasega says focusing on personal connections is the key to exchanging holiday stress for holiday serenity. It's important to appreciate those closest to you “all year rather than trying to have one intense day of caring,” says Dellasega, a professor at Penn State College of Medicine. “Focus on the significance of the holiday, first for the individual and then for the family, which can help identify what is most important.”Sargen decided to take control of the holiday madness. He talked with his family and they agreed to focus on sharing presents with personal meaning to the giver and recipient. They also replaced the long holiday mailing list, sending cards personalized with letters and photos for close relatives and friends.Sargen, of Avila Beach, Calif., says downsizing the holidays was part of his “age of simplification.” He gave up the corporate job for entrepreneurial pursuits and now heads outdoor fitness equipment provider TriActive America Inc.Now, rather than the extravagant holiday party, he enjoys a simple holiday brunch. He sets aside time to “listen to holiday music, enjoy warm apple cider or mulled wine, and celebrate the holidays with good conversation with family and friends.” Instead of last minute shopping, he keeps loved ones in mind throughout the year as he travels or shops. “I let my heart make the decision,” he says.A Working Mother's PerspectiveNicki McManigal Hayes and husband Ryan wanted their children Regan and Charlie to cherish the holiday season for its meaning rather than for gifts. “We try to celebrate with our children all season leading up to the holiday,” says Hayes, who is director of online retailer Memolink.com. On the holiday, the Hayes family plans a simple, fun activity, like sledding after Thanksgiving dinner near their Denver home.They also set spending limits and buy only for the children and grandparents. They keep the kids on their regular schedule to limit stress. And she doesn't take on holiday responsibilities she doesn't have time for. “Store-bought cookies are just as good, if not better, than homemade ones!” she says with a laugh.By not getting caught up in the holiday frenzy, the Hayes family can enjoy “saying and doing the things we don't take time for all year round,” she says. “It's the perfect time to recharge the family bonds and friendships to carry you into the New Year.”A Life-Changing HolidayFor Matt Lowe and his family, the true meaning of the holidays will be forever etched into their consciousness through his mother's brush with death three years ago. “A supposedly fatal tumor was discovered between my mom's spinal cord and brain stem,” Lowe says. “This happened 10 days before Christmas.”His mother's only hope was a dangerous surgery. Lowe, now 30, says the health professionals told the family to “brace for her death; that survival was unlikely and the best-case scenario was that she would be a vegetable.”The week before Christmas was one of the saddest and most stressful for their family. But “to the disbelief of her doctors,” Lowe says, the surgery was successful and his mother made a complete recovery. She was released from the hospital on Christmas Eve.Lowe, a public relations account director in Kansas City, Mo., says the family no longer wastes time and money on elaborate festivities. “The more elaborate the party, the less it is about the people in attendance,” he says.And they share presents valued for the thought and the humor. “Last year, I made a horrible, wood CD rack for my brother Mike, which he actually uses!”Every season since that life-altering event, Lowe says he has just two concerns for the holidays: “Will I see my favorite people, and how much are we going to laugh?”I hope you enjoyed these stories as much as I did. And with that being said, I want to thank you for your friendship and allowing me to send you the stories I cherish so much throughout this year. I hope you have a blessed and glorious Christmas. And if you do not celebrate Christmas, then happy holiday to you and yours.Merry Christmas

Freddie: Low Mortgage Rates to Hang Around Next Year

Message body

Wall Street Journal - December 14, 2011, 2:40 PM ET

Freddie: Low Mortgage Rates to Hang Around Next Year

By Drew FitzGerald

Mortgage rates are expected to remain very low at least through mid-2012, while housing activity improves slightly, according to Freddie Mac

’s economic and housing outlook released Wednesday.The outlook also projects fewer single-family home-loan originations but more multifamily lending in 2012. The rental market is likely to lead growth in the lending industry, though parts of the country will also benefit from increased activity in the single-family home market.

High unemployment and a glut of foreclosed properties have depressed the housing market in recent years, despite extremely low interest rates that have made borrowing more attractive.

“While the headwinds remain strong going into 2012, there are indications the economy and the housing market are gaining ground, albeit slowly,” said Frank Nothaft, Freddie Mac’s chief economist. “All told, next year will be another bumpy ride.”

Job growth must accelerate beyond the average monthly payroll gains of 130,000 seen this year through November for the unemployment to decrease significantly. Even then, the mortgage company predicted the unemployment rate will remain above 8% in 2012.

Freddie Mac predicts the U.S. economy will grow by about 2.5% next year.

Friday, December 16, 2011

Fw: Reinvigorate Your Holiday - 12/16 Money Pit e-Newsletter

Home Remodeling Repair & Improve Ideas & Solutions Radio & Podcasts Contact Us Community

Presented by:

When you're riding high on the holiday spirit, the last thing you want is a brown tree or burned out bulbs bringing you down. Don't let your holiday lose its sparkle! We've got tips for keeping your tree and trimmings merry and bright through the whole season. You can do-it-yourself, but you don't have to do it alone.

The Welcome Mat

This Issue

Christmas Light Repair Tips

Are your Christmas lights in need of repair? Here are five fast and easy ways to get the joy back in the joyous season without having to buy new light strings. read moreHow to Find a Long-Lasting Christmas Tree

In the market for a fresh-cut Christmas tree? When you head out on the hunt for that perfect annual pine, keep these tips in mind. read moreEnergy Efficient Holiday Tips

The average American household paid a record-breaking $1,400 for electricity last year. Stop the madness! You can save money and energy this holiday season by switching to LED holiday lights. read moreON THE AIR: Holiday Recycling Tips

Learn ways to cut down on your holiday waste by recycling. Radiant floor heating can be an efficient way to keep your house warm. Learn how a new showerhead can revolutionize your entire shower. Plus get answers to your home improvement questions about air ventilation, relaminating countertops and more. read moreHoliday Gift Guide 2011

Do you have a handy person in your life who already seems to have every tool on the planet? We can help! Get great gift ideas for everyone on your list this holiday season. read moreShare This Information With A Friend!

Simply forward this Email. And invite friends to register to receive this E-newsletter each week. If you would like to unsubscribe from our weekly newsletter, please refer to the unsubscribe directions at the bottom of this newsletter.

You are currently subscribed to moneypit_e-newsletter as: dabeisner@yahoo.com

To unsubscribe: click here or write to Squeaky Door Productions, Inc., 57 S. Main Street #133, Neptune, New Jersey 07753

Subscribe to:

Posts (Atom)